nd sales tax exemption form

Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US. SSTGB Form F0003 Exemption Certificate Revised 12212021 Streamlined Sales Tax Certificate of Exemption Do not send this form to the Streamlined Sales Tax Governing Board.

Effects Of Income Tax Changes On Economic Growth

Oregon No state sales tax NA Must pay lodging tax.

. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. See the Exempt Organizations guideline for more detail about organizations that qualify for a sales tax exemption on purchase transactions. No Sales Tax Exemption Available.

01-339 Back Rev7-107 Texas Sales and Use Tax Exemption Certification. The purchaser must complete all fields on the exemption certificate and provide the fully completed certificate to the seller in order to claim exemption. How to use sales tax exemption certificates in North Dakota.

1 The Montana resident is in North Dakota to make a purchase and not as a tourist or temporary resident. This application should be filed only by federal state local or tribal. Use North Dakota Tax Exempt Certificate.

Ad Office Depot More Fillable Forms Register and Subscribe Now. TRIBAL CLAIM FOR TAX EXEMPTION North Dakota Department of Transportation Motor Vehicle SFN 18085 5-2016 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND 58505-0780 Telephone 701 328-2725 Website. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to.

A new or expanding plant may be exempt from sales and use tax on purchases of machinery or equipment used for manufacturing agricultural commodity processing or recycling. Name of purchaser firm or agency. This certificate does not require a number to be valid.

Application for Sales Tax Exemption Certificate. APPLICATION FOR SALES TAX EXEMPTION CERTIFICATE. Hospitals nursing homes intermediate care.

Sales Tax Exemption Extension Provide a copy of the Sales and Use Tax Certificate of Exemption Rev-1220 to the retailer in order to avoid paying sales and use taxes. Sales Tax Exemptions in North Dakota. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax.

No form is needed. It allows suppliers to know that you are legally allowed to purchase the. The One Time Remittance form is for one-time sales and use tax remittance only.

3 The property will be removed from the State of North Dakota for use exclusively outside this. North Dakota residents to pay use tax on goods purchased tax free from out-of-state sellers. Not all sales are tax exempt.

Click here for certificate. The exemption is available if. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

Complete the Type of Business Section. Exempt except lodging. Taxpayer name address Federal Employer Identification Number and North Dakota sales and use tax permit number.

2 The taxable sale is 5000 or more. Other exemptions available include. Tax Exemption Google Search State Tax Tax Exemption Agreement Quote.

If you have a North Dakota Sales Tax Permit please use ND TAP to submit any sales and use tax you owe when you file your return. Send the completed form to the seller and keep a copy for your records. North Dakota provides sales tax exemptions for equipment and materials used in manufacturing and other targeted industries.

In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Include items listed in the Sales Tax Exemption Application Approval Requirements. Several examples of exemptions to the state sales tax are prescription medications some types of groceries some medical devices and machinery and chemicals which are used in agriculture.

Office Use Only This application should be filed only by federal state local or tribal governments. For other North Dakota sales tax exemption certificates go here. The North Dakota sales tax law provides for a sales tax exemption on machinery and equipment purchased by new or expanding manufacturers.

No Sales Tax Exemption Available. Name and physical address of the project. The certificate also allows you to buy items without paying sales tax that you will be reselling.

Form 301-EF - ACH Credit Authorization. North dakota sales tax hotels motels. North Dakota sales tax law provides an exemption for certain sales made to residents of Montana.

OFFICE OF STATE TAX COMMISSIONER. For other North Dakota sales tax exemption certificates go here. Guidelines for mtc form can be found here.

North dakota sales tax exemption. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax. Many states have special lowered.

08 Real estate 09 Rental and leasing 10 Retail trade 11 Transportation and warehousing 12 Utilities. The exemption does not apply to charges subject to a hotel. SFN 21919 6-2021 See the Exempt Organization guideline for more detail about organizatons that qualify for a sales tax exemption on purchase transactions.

The letter should include. Who should use this form. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses.

Certificate of resale form. In-State Sales Tax Exemption is NOT Available but items shipped to North Dakota qualify for a tax exemption. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

You can download a PDF of the North Dakota Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page. South Dakota Streamlined Sales and Use Tax Agreement SSUTA Certificate of Exemption Instructions Use this form to claim exemption from sales tax on purchases of otherwise taxable items. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to purchase goods from a supplier that are intended to be resold without the reseller having to pay sales tax on them.

Application For Sales Tax Exemption Certificate. In addition agricultural commodity processors also may qualify for a sales tax exemption on. This is a sales and use tax exemption for purchasing tangible personal property used to construct or expand a processing facility in North Dakota that produces liquefied natural gas.

You can download a PDF of the North Dakota Streamlined Sales Tax Certificate of Exemption Form SST on this page.

What Is A Tax Exemption Certificate And Does It Expire Quaderno

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

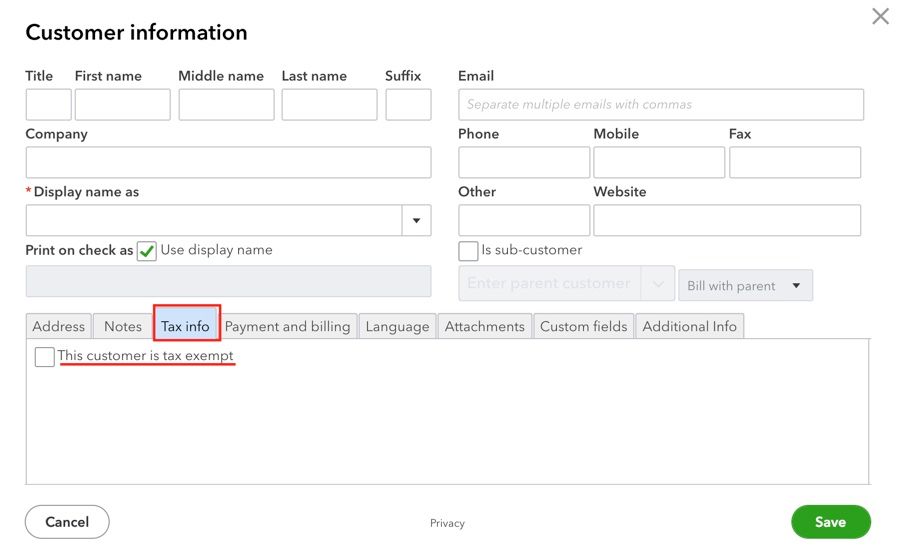

Setting Up Sales Tax In Quickbooks Online

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Selling Your Home Low Incomes Tax Reform Group

Sales Tax Guide For Online Courses

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

6d Certificate Template 4 Templates Example Templates Example Certificate Templates Professional Templates Templates

Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Tax And Financial Management Taxes Seaso Premium Photo Freepik Photo Background Business Money Text Tax Rules Financial Management Tax Season

Sales Tax By State Is Saas Taxable Taxjar

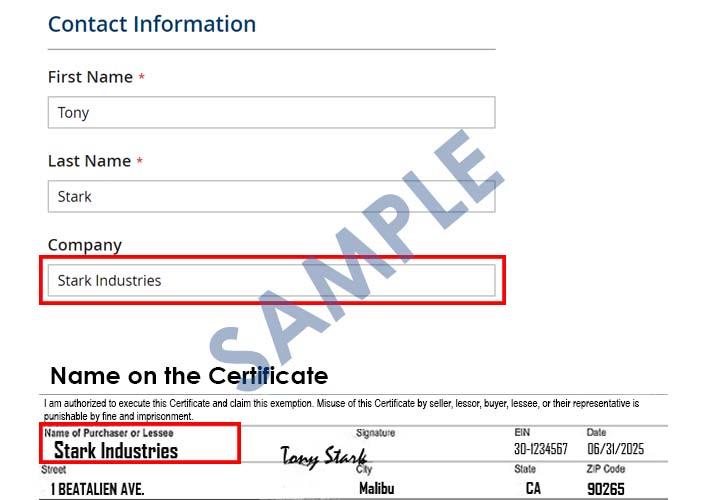

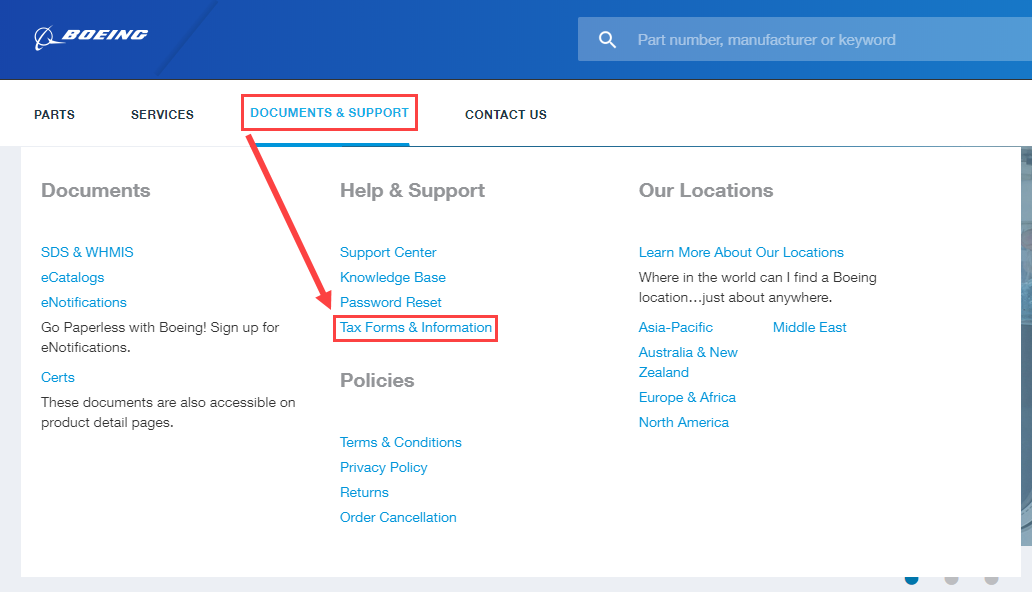

Tax Exemption Certificate Wizard Support Center

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Minnesota Revenue Form St3 For Tax Exempt Orders

Setting Up Sales Tax In Quickbooks Online

Business Leaders Think These Are The Best States For Education Business Leader Education Historical Maps